August 2020 construction PMI survey results

Contents |

[edit] Introduction

Construction sector growth slowed according to the IHS Markit/CIPS construction purchasing managers’ index (PMI) for August 2020. The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index registered 54.6 in August 2020, down from 58.1 in July 2020. Figures above 50.0 indicate growth of total construction output.

While higher levels of activity have been recorded in each of the past three months, the latest expansion was the weakest over this period.

These statistics suggest a setback for the recovery in UK construction output, as improvements continue to slow in relation to the near five-year high in July 2020. Some survey respondents indicate that a lack of new work to replace completed contracts has halted growth.

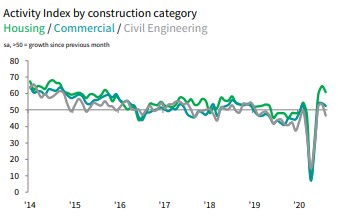

All three broad categories of construction - housing, commercial and civil engineering - registered declines in comparison to July 2020.

Source: IHS Markit/CIPS.

House building has registered the strongest rebound since work stoppages were triggered in March 2020. This trend continued in August 2020, with the seasonally adjusted Housing Activity Index at 60.7. The figure for commercial work was 52.5; civil engineering activity was 46.6 in August 2020.

[edit] Orders hold back output growth

Total new business volumes increased for the third month running during August 2020, but the rate of expansion slowed from July 2020. Construction companies noted that economic uncertainty, especially from clients, has made it more challenging to secure new work. However, survey responses were varied, mirroring the multi-speed recovery experienced across different sectors.

Supply chain disruption persisted across the sector, which led to a sharp downturn in vendor performance. Stock shortages and an imbalance of supply and demand contributed to higher purchasing costs. The overall rate of input price inflation was the highest since April 2019.

[edit] Business expectations boosted by potential infrastructure work

Despite reporting subdued new business intakes since the start of the pandemic, construction companies reported an improvement in their business expectations for 2021. More than twice as many survey respondents (43%) expect to see a rise in construction output over the next 12 months as those that anticipate a fall (19%).

This optimism was linked to anticipated involvement in major infrastructure and public sector construction projects. However, this did not stop a decrease in staffing numbers. The rate of job losses slowed slightly compared to July 2020 but overall continued at the fastest pace over the past decade.

[edit] Related articles on Designing Buildings

- Business and Planning Bill 2019-21.

- Construction market forecast 2015 to 2024.

- Construction Purchasing Managers Index (PMI) survey results: May 2020.

- Coronavirus and the construction industry.

- New deal for infrastructure 2020.

- Procurement route.

- The future of the coronavirus furlough.

[edit] External resources

- IHS Market/CIPS, Construction sector growth slows in August.

Featured articles and news

Energy industry calls for urgent reform.

Heritage staff wellbeing at work survey.

A five minute introduction.

50th Golden anniversary ECA Edmundson apprentice award

Showcasing the very best electrotechnical and engineering services for half a century.

Welsh government consults on HRBs and reg changes

Seeking feedback on a new regulatory regime and a broad range of issues.

CIOB Client Guide (2nd edition) March 2025

Free download covering statutory dutyholder roles under the Building Safety Act and much more.

AI and automation in 3D modelling and spatial design

Can almost half of design development tasks be automated?

Minister quizzed, as responsibility transfers to MHCLG and BSR publishes new building control guidance.

UK environmental regulations reform 2025

Amid wider new approaches to ensure regulators and regulation support growth.

The maintenance challenge of tenements.

BSRIA Statutory Compliance Inspection Checklist

BG80/2025 now significantly updated to include requirements related to important changes in legislation.

Shortlist for the 2025 Roofscape Design Awards

Talent and innovation showcase announcement from the trussed rafter industry.

OpenUSD possibilities: Look before you leap

Being ready for the OpenUSD solutions set to transform architecture and design.

Global Asbestos Awareness Week 2025

Highlighting the continuing threat to trades persons.

Retrofit of Buildings, a CIOB Technical Publication

Now available in Arabic and Chinese aswell as English.

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.